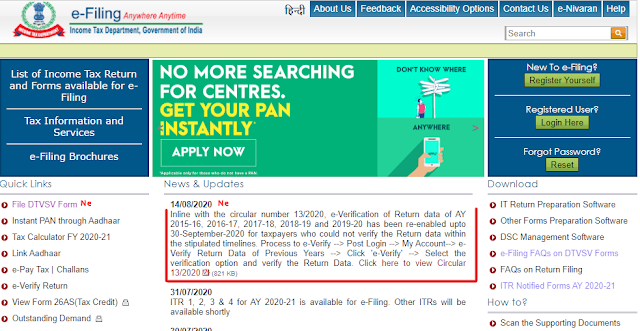

Option to E-verification of old ITRs enabled on Income Tax e-filing portal

Option to e-verification of old ITRs for AY 2015-16, 2016-17, 2017-18, 2018-19 and 2019-20 has been re-enabled as per circular 13/2020 dated 13th July 2020.

The CBDT has given one-time relaxation vide circular 13/2020 dated 13th July 2020, to verify pending Income-tax returns, filed for the Assessment Years 2015-16 to 2019-20, which are pending for processing at CPC due want of valid ITR-V form. Taxpayers are allowed to verify such returns either by sending signed copy of physical ITR-V form or through prescribed EVC/OTP modes by 30-09-2020

This option will be available up to 30th September 2020. Avail the onetime relaxation and e-verify your pending ITRs.

Process to e-Verify ⏩Post Login ⏩ My Account ⏩ e-Verify Return Data of Previous Years ⏩ Click 'e-Verify' ⏩ Select the verification option and verify the Return Data.

Comments