HSN code mandatory for gst invoice w.e.f 01/04/2021

Mandatory to quote HSN/ SAC code on invoices w.e.f 01/04/2021

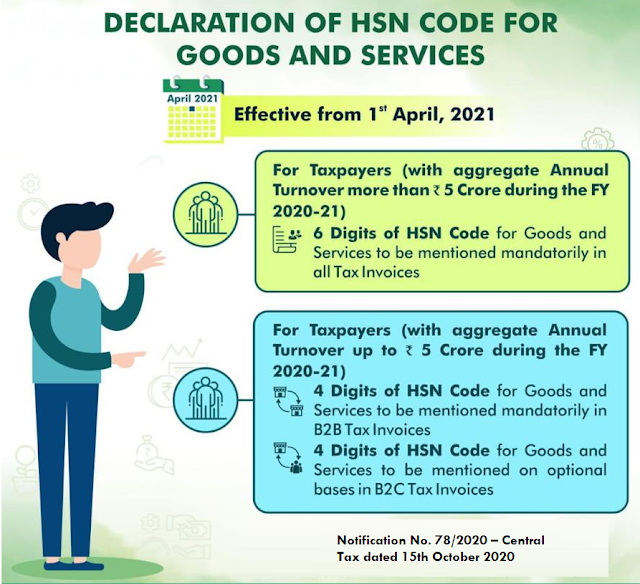

CBDT vide Notification No. 78/2020 – Central Tax dated 15th October 2020, has made it mandatory to mention 4/6-digit HSN code issuing Goods and Services Tax (GST) invoices. Prior to the date , quoting of HSN /SAC code was not mandatory on invoices for taxpayers with turnover less than 1.5 Cr. And applicability of HSN code was based on turnover.

Applicability of HSN /SAC code on sales invoices : A registered person having aggregate turnover up to five crores rupees in

the previous financial year may not mention the HSN Code, in a tax invoice issued to unregistered persons (i.e. B2C invoices)

A registered person having aggregate turnover up to five crores rupees in

the previous financial year may not mention the HSN Code, in a tax invoice issued to unregistered persons (i.e. B2C invoices)

Important points w.r.t HSN code :

- For exports 8 digits to be mentioned on export invoices and is also a requirement as per Foreign Trade Policy (FTP);

- It’s optional to show HSN codes on B2C invoices for taxpayers with turnover below Rs. 5 Crores;

- 49 chemicals as per Notification no. 90/2020 dated 01/12/2020 have to be mandatorily shown under 8 digits code.

Where to find HSN /SAC Code?

You can get list of SAC & HSN code on common GST portal. For easy reference attached herewith list of HSN & Code:Sac Code: >> Here

HSN Code:>>Here

Comments