All about DIN KYC and due date for DIN kyc

All about Director KYC i.e. DIN KYC

All directors and designated partners holding DIN (Director Identification Number) as on 31/03/2022 and the status of such DIN is ‘Approved’, needs to file form DIR-3 KYC to update KYC details on MCA portal.

E-Form DIR-3 KYC is to be filed by a din holder for filing KYC details for the first time or by the DIN holder who has already filed KYC once in e-form DIR-3 KYC but wants to update KYC details.

Web service DIR-3-KYC-WEB is to be used by the DIN holder who has submitted DIR-3 KYC e-form in the previous financial year and no update is required in his details like name, address, contact info etc.

Fees: There is no government fees for filing DIN KYC within due time. However late filing of above forms attracts fees of Rs. 5000/- (Penalty)

Due date for filing DIN kyc for the year ended March 31, 2022 is 30th September 2022. Due date for filing DIN kyc is extended up to 15/10/2022 vide General Circular 09/2022.

Personal mobile number and personal email ID is mandatory for filing form DIR-3 KYC and the same must be verified by an OTP process. Further, the mobile number and email ID must be unique such that it is not already linked with some other person in the DIN holders’ database.

Non filing of DIR-3KYC or Web KYC form will result in deactivation of your DIN and you will not be able to file any e-form with de-active DIN.

After expiry of the due date by which the KYC form is to be filed, the MCA21 system will mark all approved DINs (allotted on or before 31st March 2022) against which DIR-3 KYC form has not been filed as ‘Deactivated’ with reason as ‘Non-filing of DIR-3 KYC’.

Director KYC is compulsory for disqualified directors also.

Declaration and Engagement letter from din holder should be obtained if your are filing on behalf of someone else i.e. professionals must obtain engagement letter.

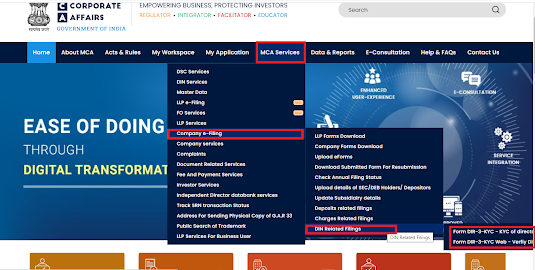

Navigation for DIN KYC on MCA V3 portal. DIN KYC can be done post login only. Registered user can file web kyc but for filing eForm DIR-3 KYC business user registration needed.

Comments