New reduced rate of Tax deduction at source (TDS) w.e.f 14/05/2020

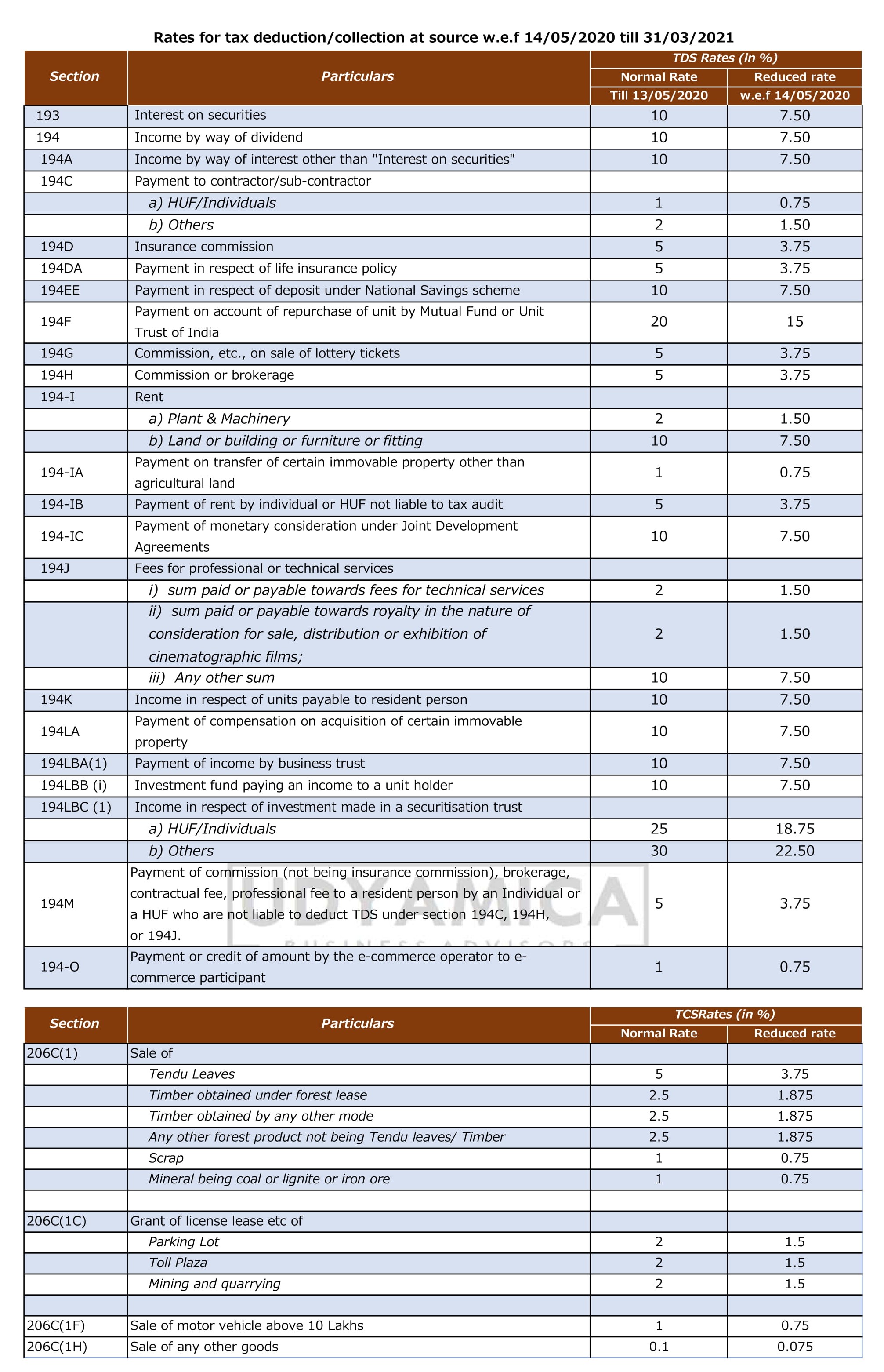

In order to provide more funds in the hands of the taxpayers the MoF has reduced the rates of the tax deduction/collection at source by 25% of the existing rate. The government has provided relief in the TDS rates for the period 14.05.2020 to 31.03.2021, due to the pandemic and resultant lockdown affecting all sectors of the economy. From the 01st April 2021, regular rate will be applicable, unless notified separately. Here is the chart of revised rates:

Comments