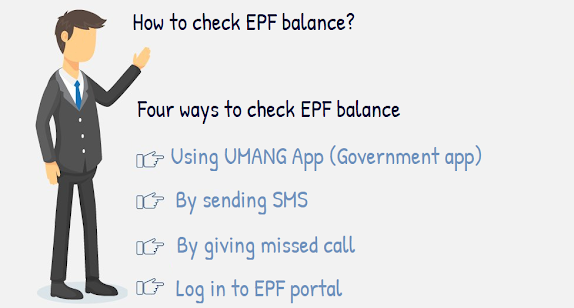

Four ways to check your EPF balance online

How to check EPF balance?

Checking EPF balance for salaried person who is member of EPF is as easy as checking prepaid mobile balance. You can check EPF balance either using Umang App, EPFO Portal, SMS or Missed call.

Here are the four ways of checking pf balance

1.Using UMANG Mobile Application: UMANG app was launched by the government to provide access to various government services in a single place. Employees can view EPF balance and access various EPF services through UMANG App. UMANG is app launched by government of INDIA. The UMANG APP can be downloaded by giving a missed call 9718397183. You can download from UMANG website or from the play/app stores.

2.Checking EPF balance using SMS service: This facility can be availed by employees having active UAN which is registered with EPFO and also have registered mobile number with EPFO. This facility can be used through registered mobile number only. All you need to do is send a text message to 7738299899. Format for SMS is “EPFOHO UAN ENG” where in UAN means your UAN number, ENG stand for your preferred language in which you will get answer. You can use HIN for Hindi, MAR for Marathi etc.

3.By giving missed call: If you have registered and activated your mobile number on the UAN portal, and also completed KYC for your UAN, you can check your balance by giving just a missed call. What you need to do is just give a missed call to 011-22901406 from the registered mobile number. The phone automatically disconnects. You will then receive details with regards to your balance and the last contribution made to your PF account in the form of a text message.

4.Through EPFO portal: Log in to your UAN account using UAN number and password to https://passbook.epfindia.gov.in/MemberPassBook/Login.jsp

Comments