Annual updation of Importer-exporter code i.e. annual KYC of IEC

Update IEC code every year, else face de- activation i.e. KYC of IEC Code

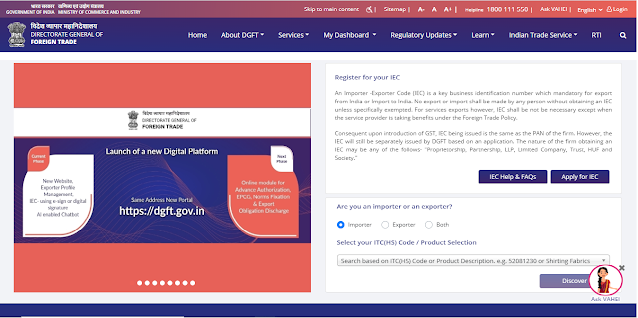

Directorate General of Foreign Trade (DGFT) has issued notification 58/2015-20 dated 12th February 2021, amending of Importer-exporter code (IEC) related provisions. Vide the notification 58/2015-20 it has been provided that, IEC holder has to ensure that details in IEC be updated annually between Apr-June period. Even though there are no change in thee IEC particulars same has to confirm annually. I.e. the notification 58/2015-20 provide for annual KYC of IEC Code.

As per the notification if IEC holder failed to update particulars within prescribed time, IEC code will be de-activated. Upon successful updation of IEC will be re-activated.

Notification also provide for scrutiny of IEC. IEC may be flagged for scrutiny , which need to address on time. Else IEC may be deactivated

DGFT vide Public Notice No. 49/2015-20 dated March 31, 2021 w.r.t. amendment in Appendix-2K of the Foreign Trade Policy, 2015- 2020 providing for nil fee on updation of Importer-Exporter Code (IEC) between April- June of each financial year.

All IECs which have not been updated after 01.07.2020 shall be de-activated with effect from 01.02.2022- Trade Notice 31/2021-22 dated 14/01/2022

IEC Code update: Read full text of the notification 58/2015-20 here:

Comments