Due date for filing DPT-3 return for the FY 2020-2021 extended

MCA E-Forms which are required to be filed between 1st April to 31st July, 2021, can be filed till 31st August, 2021 without levy of additional late fees

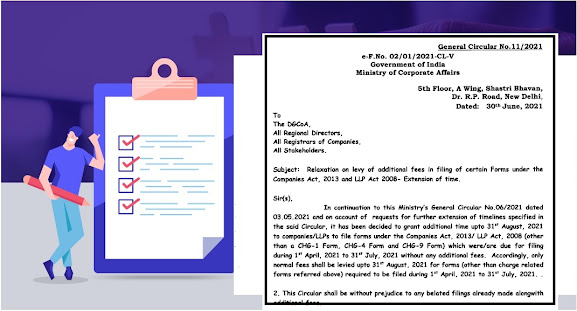

In view of the difficulties which have arisen due to resurgence of COVID-19 pandemic, MCA had decided to grant additional time up to 31st July, 2021 for companies/LLPs to file such forms (other than a CHG-1 Form, CHG-4 Form and CHG-9 Form) without any additional fees. Now in continuation to the General Circular 06/2021 dated 03/05/2021 MCA again decided to grant further time up to 31st August 2021 to file such e-forms vide General Circular No 11/2021 dated 30/06/2021 .

Accordingly, no additional fees shall be levied up to 31st August, 2021 for the delayed filing of E-forms (other than charge related forms referred above) which were/would be due for filing during 1st April, 2021 to 31st May, 2021. For such delayed filings up to 31st August, 2021 only normal fees shall be payable.

Accordingly due date for filing DPT-3 return for the FY 2020-2021 has been extended till 31st August 2021 without levy of additional late fees! DPT-3 for the FY 2020-2021 was due on 30th June 2021.

General Circular No 11/2021 dated 30/06/2021

Comments