FAQs on relief for employer and employees EPF contribution for three months

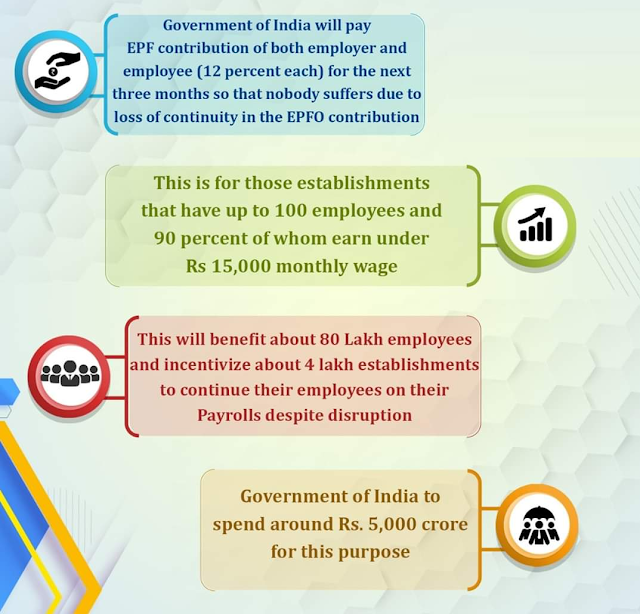

The Central Govt. has launched the Pradhan Mantri Garib Kalyan Yojana (PMGKY) on 26.03.2020 to help poor fight the battle against Corona Virus. As part of the PMGKY package, with a view to prevent disruption in the employment of low wage earning EPF members and support EPF covered establishments employing up to one hundred employees, the Central Govt. proposes to grant relief in form of credit of EPF & EPS contributions (24% of wages) for three months.

Eligibility for Scheme benefits:

A. For Establishments: To be eligible for benefits, following conditions should be fulfilled:

(i) The establishment or factory should already be covered and registered under the

Employees’ Provident Funds & Misc. Provisions Act, 1952.

(ii) The total number of employees employed in the establishment should be up to

100 (one hundred), with 90% or more of such employees should be drawing monthly

wages less than Rs.15000/-.

B. For Employees:

(i) Employee should be employed in any eligible establishment earning monthly wages

of less than Rs.15000/-. The UAN of the employee should be seeded with his/her

Aadhaar.

(ii) Employee should be a member of EPF Scheme, 1952 & Employees’ Pension

Scheme, 1995 whose contributions are received for any period during last six months

(September 2019 to February 2020) in the ECR filed by any eligible establishment

against his/her UAN.

Such contributions in ECR should have been received on monthly wage of less than

Rs.15000/-

(iii) It is clarified that if any employee is already a registered beneficiary and his/her

employer is availing benefits of payment of employer’s share by Central Govt. under

You can access details and FAQs with respect to the scheme here

| Particulars | Link |

| Scheme Press Brief | View |

| Scheme Guidelines | View |

| Circular | View |

| How to avail the scheme | View |

| Scheme FAQs | View |