How to Change/Update Date of Birth(DOB) in the EPF UAN Portal by Online using Aadhar

The date of birth recorded in 'Aadhaar' will now be accepted as valid proof of date of birth for the purpose of rectification, provided that the difference in the two dates is less than 3 years.

In a move to extend the availability and reach of online services in the wake of the COVID-19 pandemic, EPFO has issued revised instructions to its field offices to facilitate PF members to rectify their date of birth in EPFO records, thus ensuring that their UAN is KYC compliant.

The date of birth recorded in 'Aadhaar' will now be accepted as valid proof of date of birth for the purpose of rectification, provided that the difference in the two dates is less than 3 years.

The PF subscribers can submit the correction requests online. This will enable EPFO to validate the date of birth of members online with UIDAI instantaneously, thus authenticating and reducing the processing time of change requests.

EPFO has instructed field offices to expedite disposal of online requests, enabling PF members in financial distress, to apply online for availing non refundable advance from their PF accumulations to tide over the COVID-19 pandemic.

-------------------------------------

How to Change/Update Date of Birth(DOB) in the EPF UAN Portal by Online

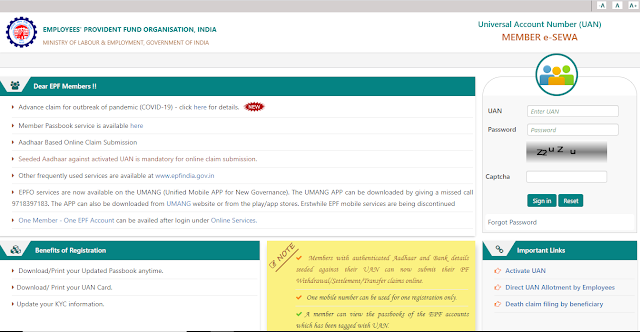

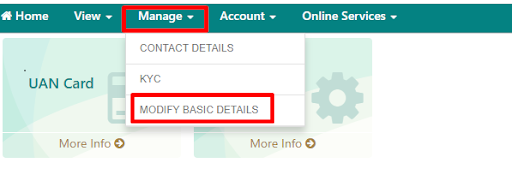

Step 1: Go to UAN Portal and Login in with your UAN & Password https://unifiedportal-mem.epfindia.gov.in/memberinterface/Step 2: Once you have logged in, Click on Manage and then Click on Modify Basic Details

Step 3: Enter the Date of Birth which is as per your AADHAR on the right side and then Click on “Update”

Step 4: Once you have clicked on Update, A message would be displayed as “Pending approval by Employer”

Step 5:Call/Contact the Employer and ask them to approve your changes.Once they have approved, it would display this message and after which EPF Office has to approve the changes.