Revised FAQs on EPF Advance to Fight Covid-19 Pandemic dated 26.04.2020

Q1: What is the process for change in name on marriage of

a woman member against UAN when changes are made in Aadhaar?

Ans: The name change

process if the Aadhar data is changed is similar to other change requests.

Member has to apply online and employer will digitally approve the request. The

correction request can be submitted online or offline (joint request) along with

a copy of the marriage certificate or such other documents which can prove that

only the name of the member has changed from before marriage. Documents like school

records containing Father's name and Date of birth or PAN taken before marriage

etc. are a useful to show that only name has changed after marriage.

Q2: The link ‘Know your UAN’ is not available on unified portal.

Is approaching employer for this the only option?

Ans: Visit unified member

portal at https://unifiedportal-mem.epfindia.gov.in/memberinterface

Ø Select Member ID, Aadhaar or PAN

Ø Enter details such as name, date of birth, mobile number and e-mail

id as per EPFO records

Ø Click on the “Get Authorization Pin” option

Ø A Pin will be sent to your mobile number registered with EPFO

Ø Enter the Pin and your UAN will be sent to the mobile number

Q.3: I have already applied advance for illness in March 2020

which is pending. I want to apply for advance to fight COVID pandemic now. What

should I do?

Ans: During pendency

of any other advance, the application for COVID-19 claim is permitted.

Q.4: KYC updation needs approval by Employer by using his

DSC. When Establishment is closed and there is no Employer, who is to approve the

same?

Ans: The approval of

KYC by employer is an online facility which can be operated irrespective of the

location. Please request the employer to approve the KYC.

Q5: For filing of claim a copy of cheque with name of member

or copy of pass book Is to be uploaded. Member does not have name on his cheque

leaf and it is now difficult to get it from Bank. Even going to bank and getting

an attested copy of bank statement is not easy as Banks are far away. What is the

other option that can be made available?

Ans: As per prevailing

instructions it is mandatory to upload a cheque leaf containing the printed name

of the member, or the first page of the bank Passbook or bank statement containing

the name, account number and IFSC. This is required to ensure that the bank account

number uploaded in the KYC is correct and erroneous payments are avoided.

Q.6: I have worked for two companies and working in third

one now. How to get PF accumulations of earlier companies transferred to present

one so that I can file claim for COVID advance?

Ans: In case the

name, date of birth and gender in all the accounts is same, the member can apply

online for transfer through his login. The present UAN should be validated with

Aadhar. In case of difference once he gets the basic details corrected in other

accounts, he can apply online.

Q.7: You claim to settle COVID advance claims within 72 hours?

It is over 4 days when I applied. I have still not received the money in my bank

account. Why?

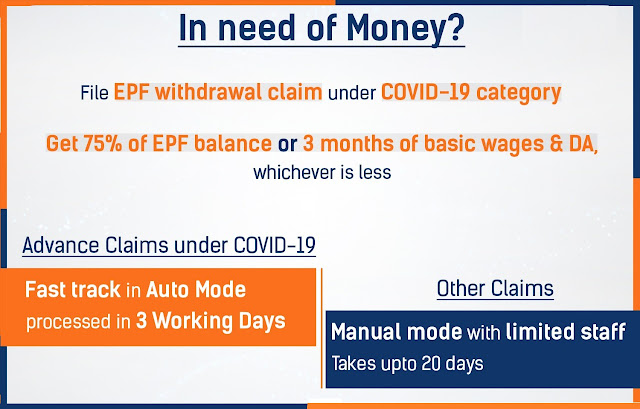

Ans: EPFO settles

claims for availing advance to fight COVID-19 pandemic within 03 working days. After

processing of the claims, cheque is sent to the bank for crediting amount to bank

account of the claimant. Bank usually take additional one to three working days

to credit advance in your bank account.

Q.8: I live in city A and work in City B. However, Head Office

of my company is in city C. Which EPF office has to be contacted for any matter?

Ans: You should

approach EPF office where your establishment is registered. To find concerned EPF

office where your establishment is registered visit:

https://unifiedportalepfo.epfindia.gov.in/publicPortal/noauth/misReport/home/loadEstSearchHome

https://unifiedportalepfo.epfindia.gov.in/publicPortal/noauth/misReport/home/loadEstSearchHome

Ø Fill in establishment PF code or name

Ø Enter captcha and click on search

Ø Establishment details will appear in tabular format.

Ø

Confirm the establishment Id,

Name and Address and in column four EPF office name is provided.

Q.9: I need to contact the EPF office through email or phone.

Please provide me contact details of EPF office.

Ans: Please visit

https://www.epfindia.gov.in/site_en/Contact_us.php Click on the Zonal office under

which EPF Regional/District office falls>> Click on concerned Regional/District

office to get their contact details.

Q.10: I have applied for COVID epidemic advance. How to check

status of my claim?

Ans: Visit https://passbook.epfindia.gov.in/MemberPassBook/Login.

Click online services>>track claim status.

Q.11: I work in a company in Jammu which was covered under

J&K PF Act. Since last year this company is covered under Employees Provident

Fund Act, 1952. Can I file claim for fighting COVID pandemic?

Ans: Yes. member

can apply for advance from the contributions received by EPFO.

Q.12: Why your toll-free number is not accessible?

Ans: Services will

be resumed shortly. Pending resumption of services, you may contact us on our Facebook

and twitter handle “socialepfo”. You can raise your grievances at epfigms.gov.in.

Q.13: I have a balance of Rs 100000 in my PF account and applied

for Rs 75000advance for COVID. At the rate of 75%, I should get Rs. 75000. Why a

much lesser amount has been credited to my account?

Ans: The 75% of

the amount standing to your credit is maximum permissible limit and the same is

applicable if it is lesser than basic wages and dearness allowances for three months.

If 75% of the balance is more than three months wages, advance equal to three months

wages (Basic+DA) is sanctioned as per the rules. If your monthly wage is Rs.20000,

the entitled advance amount is Rs 60000 only. If the monthly wages are Rs 30000,

the amount of advance will be restricted to Rs.75000.

Q.14: I am not able to file COVID claim. Please help me. The

process is also noted below:

Ans: Follow this steps

Ans: Follow this steps

ØLogin to Member Interface of Unified

Portal(https://unifiedportalmem.epfindia.gov.in/memberinterface)

Ø Go to Online Services>>Claim (Form-31,19,10C & 10D)

Ø Enter your Bank Account and verify

Ø Click on “Proceed for Online Claim”

Ø Select PF Advance (Form 31) from the drop down

Ø Select purpose as “Outbreak of pandemic (COVID-19)” from the drop down

Ø Enter amount required and Upload scanned copy of cheque and enter your

address

Ø Click on “Get Aadhaar OTP”

Ø Enter the OTP received on Aadhaar linked mobile.

Ø Claim is submitted

Q.15: I have balance available in my account. How many times

I can get advance to fight COVID?

Ans: The advance

to fight COVID-19 pandemic is available once only.

Q.16: What is the last date for applying COVID advance?

Ans: The facility

for availing advance to fight COVID-19 pandemic will be available till the pandemic

prevails.

Q.17: I have two different UANs. The first UAN is linked with

one PF member ID and the second UAN is linked with 2 different member IDs. Can I

avail COVID advance benefits? How to get maximum benefit in this case.

Ans: Yes. In order

to get maximum benefits, you are requested to transfer all the previous services

(linked with multiple member IDs) to the latest member ID. This can be done by filing

a transfer claim. Once the service is successfully transferred your entire PF corpus

will reflect against the latest member ID. Subsequently you can file COVID advance

claim to reap maximum benefit.

Q.18: My COVID claim has been rejected due to member details

mismatch. How can I rectify this issue?

Ans: You can update

your member details by logging into member e-sewa portal available at https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

Once the details are updated you can file the claim once again.

Q.19: How can I file COVID claim through UMANG app?

Ans: Please

refer following steps

·

Step 1: Open Umang app

·

Step 2: Select EPFO

·

Step 3: Select “Request for

Advance (COVID-19)”

·

Step 4: Enter your UAN details

and click on 'Get OTP' to get one-time password. Use this OTP to login in your account.

·

Step 5: Enter the OTP and click

on login. Once you are logged in you are required to enter the last four digits

of your bank account and select the member ID from the drop-down menu. Click on

“Proceed for claim”

·

Step 6: Enter your address.

Click on 'Next'.

·

Step 7: Upload the cheque image

with your account number and name printed on it.

Once all the details

are entered, your claim will be successfully filed.

Q.20: I have left the service but not yet availed the final

PF withdrawal benefits. Can I still avail the COVID advance?

Ans: Yes. COVID

advance can be filed by any PF subscriber. Since you have not withdrawn your PF

funds you are still a PF member.

Just sharing:

Please do not withdraw your EPF unless your are really in need of money. EPF is long term saving and gives handsome return in long term.